- Know Your Numbers Inside Out. Before you even think about borrowing, understand exactly how much additional monthly payment you can handle without choking your cash flow. I recommend calculating three scenarios: best case, realistic, and “oh shit” situations.

- Shop Multiple Lenders. Don’t just go to your usual bank. Credit unions, community development financial institutions (CDFIs), and even some online lenders are competing hard for good borrowers. A difference in 1-2 percentage points can be the difference between hundreds or thousands of dollars.

- Lock in Terms Now. If you need financing in the next 12-18 months, start the process now. Most forecasts expect the Fed to begin cutting rates lightly in late 2025 or early 2026, but only if inflation trends down and the labor market weakens, Morningstar analysts report. There’s no guarantee rates will drop significantly in 2026.

- Build Cash Reserves Aggressively. This isn’t the time to operate on thin margins. Every extra dollar you can keep in reserves gives you options when opportunities arise or emergencies hit.

How Washington’s Interest Rate Policy Is Squeezing Main Street

Listen to this article

By Ray’Chel Wilson, CFEI, CFT-I

The Fed’s 4.5% rates aren’t just numbers on a screen, they’re changing how businesses survive.

Business owners across America have grown accustomed to their projections being inaccurate. First, supply chain disruptions threw off pricing models.

Then came inflation that made their cost estimates obsolete within months. Now there’s a new threat reshaping business plans: persistently high interest rates that are hitting mid-market cities like Cleveland and Tulsa far harder than coastal metropolitan areas.

Take manufacturing shops in Cleveland’s industrial corridors. Many had been planning equipment upgrades for two years, carefully budgeting based on 2022 interest rates.

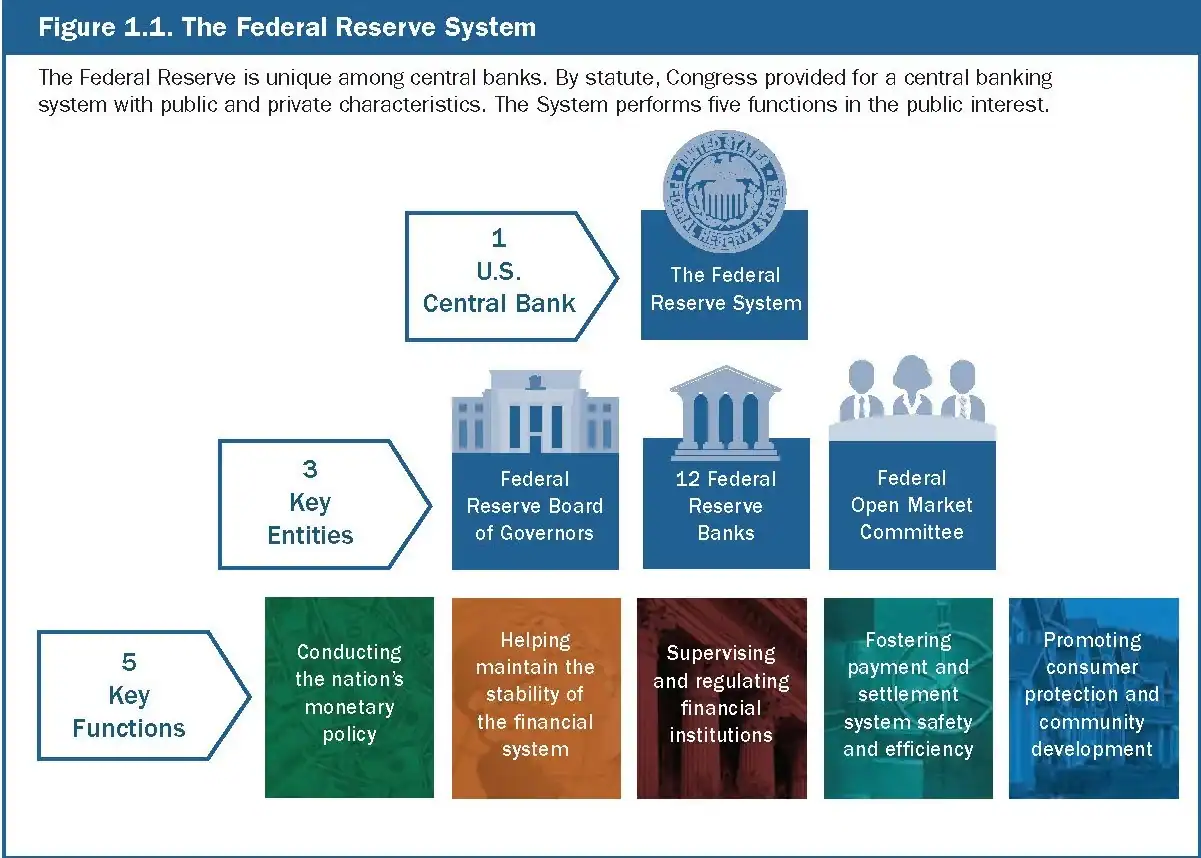

However, the Federal Reserve has kept interest rates in the 4.25% to 4.5% range through its July 2025 meeting, according to the central bank’s latest policy statement, creating sustained pressure on business financing across mid-market cities.

A Federal Reserve Bank of Cleveland survey found that 64% of manufacturers expect higher rates and tariffs to hurt their bottom line. The Cleveland Fed’s May 2024 Beige Book reported economic expansion at a slower pace, with the slowdown ‘often attributed to diminished hopes for interest rate cuts.’

This pattern is fundamentally changing how local businesses operate in cities that rely heavily on small and mid-sized enterprises rather than large corporations with diverse financing options.

The Real Math Behind the Headlines

While big corporations can secure loans at around 6.5% interest rates, small businesses are paying closer to 10.5% and that gap is widening, according to Goldman Sachs Research. Think about what that means in real dollars using standard loan calculations.

A $100,000 five-year equipment loan at 6.5% would cost approximately $1,950 per month, while the same loan at 10.5% would cost approximately $2,150 per month, a difference of $200 monthly, or $12,000 over the life of the loan.

Recent surveys and industry reports confirm these impact patterns across both cities. In Cleveland, manufacturers such as Cleveland-Cliffs have postponed major equipment investments and idled capacity, citing persistent high interest rates and demand uncertainty; they plan to resume upgrades only when credit costs decrease and pricing stabilizes.

Across mid-market cities nationwide, businesses are facing challenges financing equipment due to persistent high interest rates and tariff uncertainty.

According to an August 2025 Equipment Leasing and Finance Foundation’s Monthly Confidence Index, the majority of equipment lenders reported slower new business volume and a ‘wait-and-see’ approach for capital purchases, with business conditions expected to remain tight until interest rate relief arrives.

According to Goldman Sachs Research, by 2024, interest payments as a share of small business revenue nationwide climbed from 5.8% in 2021 to about 7%, with forecasts suggesting it will rise closer to 8% as older loans reset at higher rates. The math is straightforward: higher borrowing costs mean less capital investment, restrained growth, and fewer new jobs across mid-market cities like Cleveland and Tulsa.

Why Mid-Market Cities Feel It More

Here’s the reality that doesn’t make headlines: mid-market cities like Cleveland and Tulsa are experiencing this interest rate squeeze more intensely than coastal metropolitan areas.

Large metropolises have diverse economies with multiple industries, abundant venture capital, and businesses that can access various financing options. Mid-market cities rely heavily on local banks and community lenders, which means fewer financing alternatives when rates spike.

Moreover, the businesses that drive these local economies—manufacturers, energy service companies, family restaurants—typically operate on thinner margins than their big-city counterparts. They don’t have the financial cushion to absorb sudden increases in borrowing costs, and they can’t easily pass those costs on to customers who are also feeling economic pressure.

Cleveland and Tulsa might seem different on the surface, but they’re experiencing remarkably similar pressure points. Cleveland’s manufacturing base is dealing with a double hit—higher interest rates and new tariffs are making it expensive to both upgrade equipment and manage supply chains. A Federal Reserve Bank of Cleveland survey found that 64% of manufacturers expect these combined pressures to hurt their bottom line.

Meanwhile, in Tulsa, energy service companies that keep Oklahoma’s oil industry running are finding it harder to lease equipment or expand operations.

Oklahoma State University’s December economic outlook noted that business investment growth has slowed significantly in 2025, with companies reporting that tariff-fueled inflation and costly capital outlays have forced more cautious spending decisions.

Pipeline maintenance companies are putting truck purchases on hold because financing costs would eat up nearly all their projected profit margins.

But here’s where it gets personal: the restaurants, coffee shops, and retail stores that give these cities their character are getting squeezed the hardest. These businesses typically need working capital to manage cash flow between slow and busy seasons.

With banks tightening lending standards and charging higher rates, nearly half of surveyed small businesses report declining revenue and profits, with many expecting no near-term improvement without rate relief, according to a Federal Reserve Bank of Minneapolis study. Many are going into survival mode instead of growth mode.

The Survival Playbook

If you’re a business owner feeling this pressure, here’s what actually works right now:

What’s Really at Stake

This isn’t just about individual businesses, it’s about the economic DNA of small market cities. When local manufacturers can’t upgrade equipment, they become less competitive nationally.

When energy service companies can’t expand, they miss out on contracts that could employ dozens of people. When that corner coffee shop can’t get working capital, it closes, and the community loses a gathering place.

The Federal Reserve isn’t trying to hurt small businesses, but its interest rate policy hit Main Street harder than Wall Street, and mid-market cities harder than major metropolitan areas. Big corporations have multiple financing options and can weather higher costs. Coastal towns have diverse economies and access to various capital sources. Mid-market municipalities often don’t have these advantages.

The Bottom Line

Business owners eventually find ways to adapt, often by securing financing through local credit unions at rates 1-2 points lower than major banks quote. Monthly payments may still be higher than initially projected, but they become manageable. More importantly, successful businesses don’t give up on growth—they adjust their strategies.

That’s the lesson here: higher rates are a challenge, not a death sentence. The businesses that will thrive are those that adapt quickly, maintain strong relationships with multiple lenders, and make decisions based on realistic math rather than wishful thinking.

Don’t let Washington’s interest rate games dictate your business future. Know your options, act strategically, and remember, every economic cycle eventually turns.

Ray’Chel Wilson, a Toledo native, and author. She is a certified financial educator and financial therapist who researches stewardship, economic development, and leadership to promote financial flourishing.